Average tax rate calculator

Calculate the tax savings. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules.

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial

The average tax rate is the total amount of tax divided by total income.

. Effective tax rate 561. 0 would also be your average tax rate. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

Total income tax -12312. This is 0 of your total income of 0. This is 0 of your total income of 0.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Your income puts you in the 10 tax bracket. This is 0 of your total income of 0.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. There are seven federal tax brackets for the 2021 tax year. At higher incomes many deductions and many credits are phased.

10 12 22 24 32 35 and 37. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Calculate your combined federal and provincial tax bill in each province and territory. Your household income location filing status and number of personal. Your bracket depends on your taxable income and filing status.

Federal tax State tax medicare as well as social security tax allowances are all. 100 Accurate Calculations Guaranteed. The average tax rate also known as the effective tax rate is the percentage of taxes paid or due out of the total taxable income.

These are the rates for. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Start filing your tax return now.

This information may be found in the 1040. New York state tax 3925. 0 would also be your average tax rate.

That means that your net pay will be 43041 per year or 3587 per month. Ad Try Our Free And Simple Tax Refund Calculator. 0 would also be your average tax rate.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Realistic property value growth will not raise your yearly bill enough to make a protest. Your income puts you in the 10 tax bracket.

Your income puts you in the 0 tax bracket. Personal tax calculator. 0 would also be your average tax rate.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Your taxes are estimated at 0. Your income puts you in the 10 tax bracket.

How do you calculate average tax rate example. Find your real property tax payment incorporating any tax exemptions that apply to your real estate. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars.

This is 0 of your total income of 0. As this calculator shows even if taxable income puts you in a particular income tax bracket overall you benefit from being taxed at the lower brackets first. For example if a household has a total income of.

Find your total tax as a percentage of your taxable income. At higher incomes many deductions and many credits are phased. Marginal tax rate 633.

At higher incomes many deductions and many credits are phased. The 38 Medicare tax will.

Details Of The Fifo Lifo Inventory Valuation Methods Method Financial Management Inventory

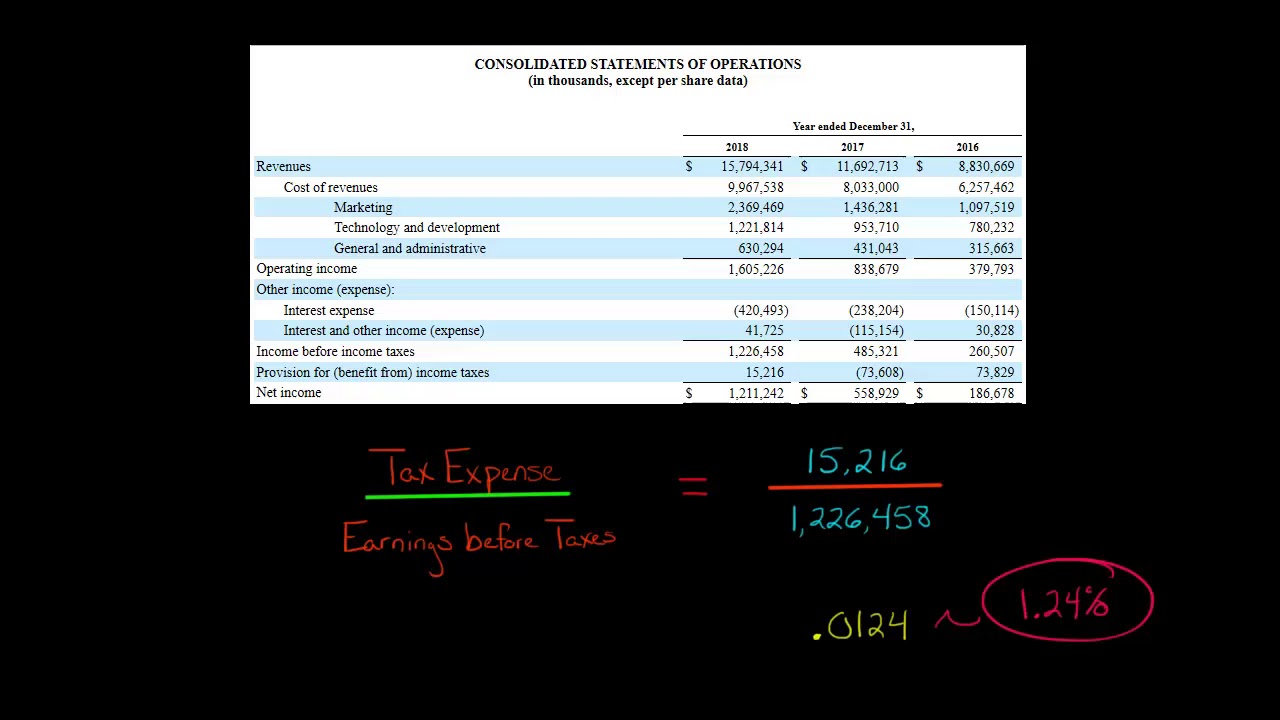

Effective Tax Rate Formula Calculator Excel Template

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Excel Formula Income Tax Bracket Calculation Exceljet

Marginal And Average Tax Rates Example Calculation Youtube

How To Calculate The Effective Tax Rate Youtube

What Is My Net Worth And How Do I Calculate It Net Worth Investment Accounts Finance Goals

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Concentration Ratio Vs Herfindahl Hirschman Index Market Structure Microeconomics Concentration Sales And Marketing Basic Concepts

Nyc Nys Transfer Tax Hauseit Nyc Closing Costs Transfer

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Marginal Tax Rate Formula Definition Investinganswers

Pin On Accounting Class

Stamp Duty Calculator In 2022 Stamp Duty Finance Apps Stamp

Pin On Its 320